We are excited to announce the establishment of the International Board of Advisors

We are excited to announce the establishment of the International Board of Advisors, a distinguished group of accomplished leaders who will provide invaluable guidance for the strategic vision of Newport Logistics Fund III and Panattoni Income Fund.

🌍📈 Our advisors are highly regarded professionals with decades of experience in global real estate, fund management, investment strategies, and ESG initiatives. Their combined insights will be crucial in enhancing our funds' market positioning, fostering innovation, and delivering exceptional value to our investors.

Introducing Our Board Members:

🔹 Daniel Raemy - A financial professional with 30 years of experience in private banking (UBS & J. Safra Sarasin), focused on investment strategies.

🔹 Doris Pittlinger – Former Managing Director at Invesco Asset Management, with expertise in fund management and ESG integration.

🔹 Will Rowson – Global real estate expert with 35 years of experience (incl. CBRE IM, Hodes Weill & Associates) and founder of Newland Capital Partners.

🔹 Jean Lavieille – Former Deputy CEO at AEW Europe, known for the success of the €5 billion Logistis Fund.

🔹 Richard Apfelbacher – Managing Partner at Loumar IM Switzerland AG, with 25 years of investment experience.

Their diverse backgrounds and perspectives will enhance our governance and drive forward-thinking strategies for our funds. We look forward to sharing updates on their contributions to our investments across Europe and beyond.

Strategic investment from Newport Logistics Fund II: French project is a 7,300 m2 cargo facility at Lyon Saint - Exupéry Airport

🛫 We are proud to announce the start of construction on our latest investment from Newport Logistics Fund II: a 7,300 m² multimodal cargo facility located in the heart of the CargoPort area at Lyon Saint-Exupéry Airport. This project demonstrates our commitment to high-value logistics developments throughout Western Europe. We are thrilled to partner with Panattoni France on this forward-thinking development, with delivery scheduled for Q4 2025. 💼

🛣️ The facility features direct access to the A43 and A432 motorways, along with great public transport options.

🔧 Built by HTC and designed by ATELIER 4+, it uses low-carbon materials and includes solar panels and a water recovery system, aiming for BREEAM Excellent certification. These measures will reduce CO₂ emissions by 25%.

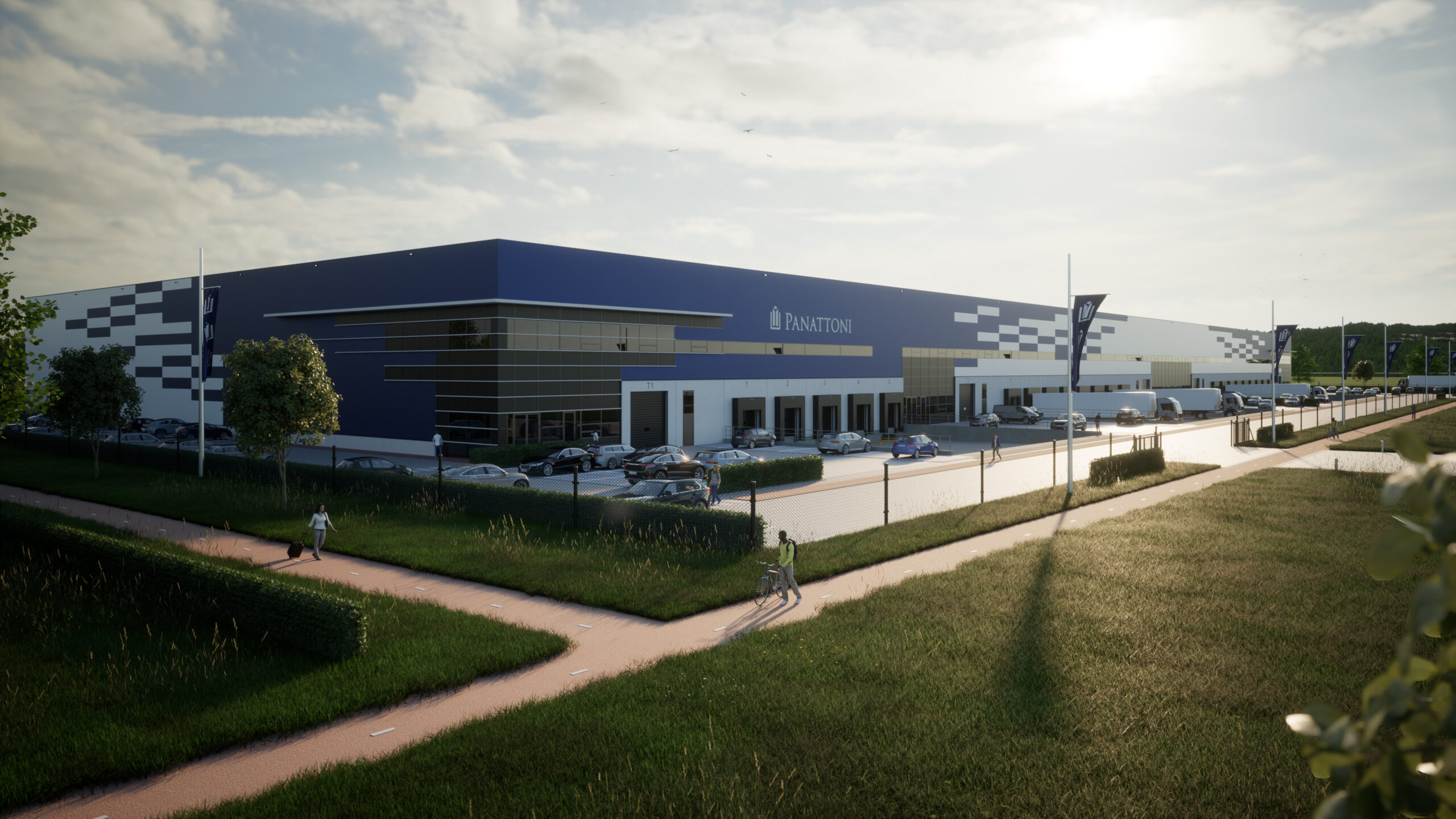

Newport Logistics Fund sells Amsterdam development from its first fund to end user

Newport Logistics Fund, Luxembourg investment company, has sold the first development from its first fund, achieving an internal rate of return of 20.3%.

The project, located just 30 minutes from two of the most important cities of the Netherlands - Amsterdam and Utrecht -, has been completed and sold to the occupier, a global company, which will use the facility for its production and distribution.

The facility totals 23,420 sq m, comprising 19,666 sq m of industrial space, 2,158 sq m of office space and 1,596 sq m of mezzanine space, with 258 parking spaces. Developed to meet BREEAM ‘Very Good’ sustainability standards, it reflects Newport’s commitment to creating future-proof, environmentally responsible assets.

The development aligns with Newport Logistics Fund I’s strategy of find high-quality logistics facilities in core European markets. The property’s strategic location, with access to 12 million people within one hour’s drive, underscores the fund’s focus on investments in high-demand regions with strong connectivity and growth potential.

Szymon Ostrowski, Managing Director of Newport Logistics Fund, said: “We are delighted with the successful development and delivery of this project, ideally situated just a short distance from Amsterdam, the vibrant capital of the Netherlands. This facility not only exemplifies sustainable industrial design but also showcases the value of strategic investments in high-demand regions. As one of the standout projects of Newport Logistics Fund I, this milestone demonstrates the fund’s ability to deliver extraordinary returns for its investors”.

The success of this project was made possible through collaboration with the developer, Panattoni.

Newport Logistics Fund I invested in three modern logistics facilities in London, Amsterdam and Lodz with a gross development value of €100 million. The Newport series of funds finance the full development cycle (land acquisition, construction, lease and sale) of modern logistics warehouses in Europe and aim to generate a return of 15% a year. They are part of the Panattoni group. Capital is sourced from professional Investors principally high-net-worth individuals and family offices from the EU, Switzerland, the UK, the US and the Middle East.