Strategic investment from Newport Logistics Fund II: French project is a 7,300 m2 cargo facility at Lyon Saint - Exupéry Airport

🛫 We are proud to announce the start of construction on our latest investment from Newport Logistics Fund II: a 7,300 m² multimodal cargo facility located in the heart of the CargoPort area at Lyon Saint-Exupéry Airport. This project demonstrates our commitment to high-value logistics developments throughout Western Europe. We are thrilled to partner with Panattoni France on this forward-thinking development, with delivery scheduled for Q4 2025. 💼

🛣️ The facility features direct access to the A43 and A432 motorways, along with great public transport options.

🔧 Built by HTC and designed by ATELIER 4+, it uses low-carbon materials and includes solar panels and a water recovery system, aiming for BREEAM Excellent certification. These measures will reduce CO₂ emissions by 25%.

Newport Logistics Fund sells Amsterdam development from its first fund to end user

Newport Logistics Fund, Luxembourg investment company, has sold the first development from its first fund, achieving an internal rate of return of 20.3%.

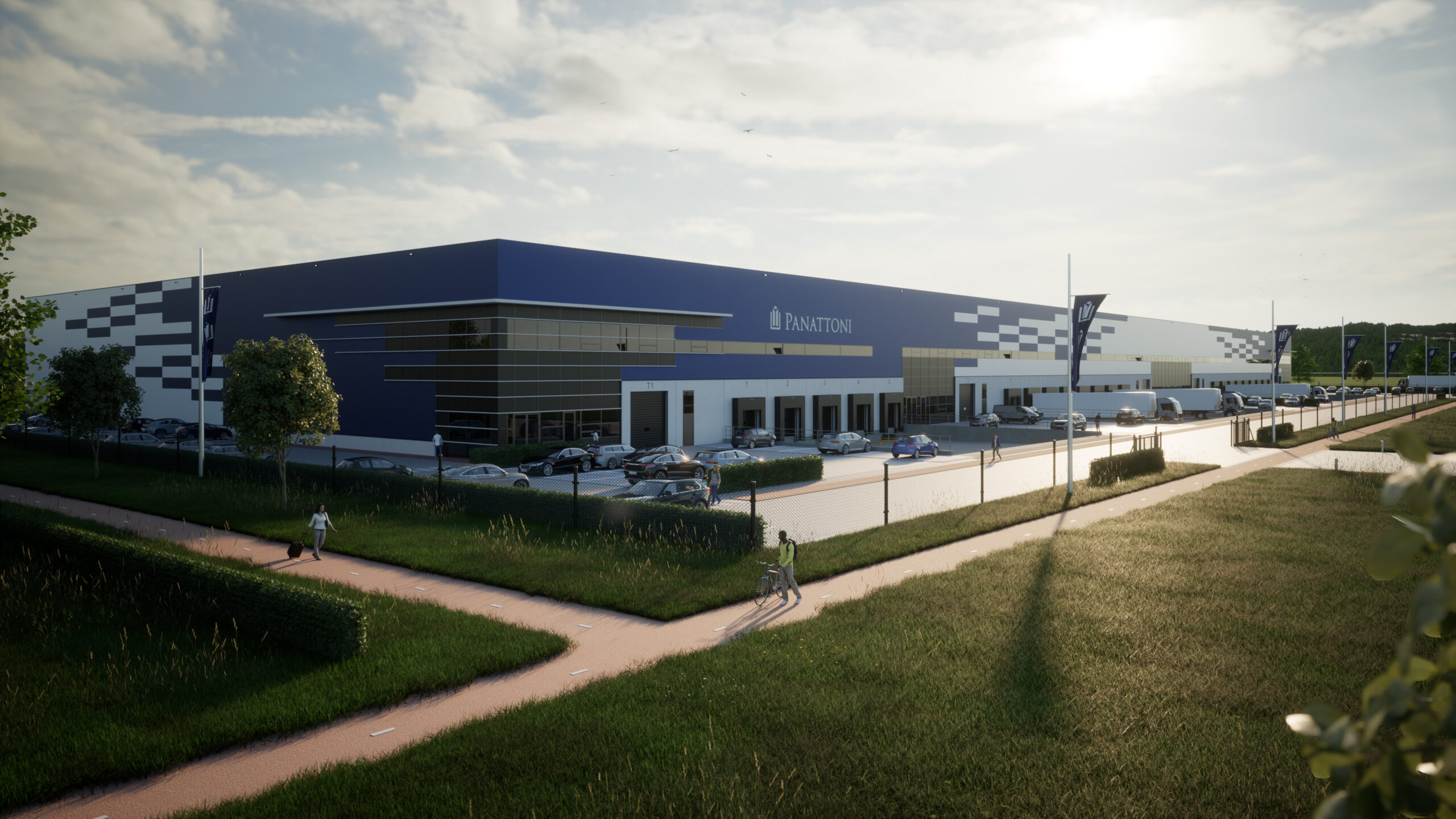

The project, located just 30 minutes from two of the most important cities of the Netherlands - Amsterdam and Utrecht -, has been completed and sold to the occupier, a global company, which will use the facility for its production and distribution.

The facility totals 23,420 sq m, comprising 19,666 sq m of industrial space, 2,158 sq m of office space and 1,596 sq m of mezzanine space, with 258 parking spaces. Developed to meet BREEAM ‘Very Good’ sustainability standards, it reflects Newport’s commitment to creating future-proof, environmentally responsible assets.

The development aligns with Newport Logistics Fund I’s strategy of find high-quality logistics facilities in core European markets. The property’s strategic location, with access to 12 million people within one hour’s drive, underscores the fund’s focus on investments in high-demand regions with strong connectivity and growth potential.

Szymon Ostrowski, Managing Director of Newport Logistics Fund, said: “We are delighted with the successful development and delivery of this project, ideally situated just a short distance from Amsterdam, the vibrant capital of the Netherlands. This facility not only exemplifies sustainable industrial design but also showcases the value of strategic investments in high-demand regions. As one of the standout projects of Newport Logistics Fund I, this milestone demonstrates the fund’s ability to deliver extraordinary returns for its investors”.

The success of this project was made possible through collaboration with the developer, Panattoni.

Newport Logistics Fund I invested in three modern logistics facilities in London, Amsterdam and Lodz with a gross development value of €100 million. The Newport series of funds finance the full development cycle (land acquisition, construction, lease and sale) of modern logistics warehouses in Europe and aim to generate a return of 15% a year. They are part of the Panattoni group. Capital is sourced from professional Investors principally high-net-worth individuals and family offices from the EU, Switzerland, the UK, the US and the Middle East.

Szymon J. Ostrowski appointed to the Public Affairs Committee at INREV for a 3-year term starting in 2025

The committee plays a crucial role in advocating for non-listed real estate investments in Europe. Szymon will join a group of professionals focused on:

🔹 Analyzing regulatory impacts to keep the industry connected with policymakers.

🔹 Monitoring key regulatory initiatives (including SFDR and EU Taxonomy).

🔹 Providing updates on regulatory developments.

This year, 52 new committee members were selected from 179 applicants across 16 countries, representing 11 committees in 2025.

Committee members are chosen for their expertise in the private real estate market and relevant European regulations.

The Panattoni Poyle 80 project officially took off without any delays

The Panattoni Poyle 80 project officially took off without any delays on November 5, 2024, during the Poyle Breakfast Launch Event. We celebrated the grand opening of a 79,216 sq ft last-mile logistics development in West London.

We are proud to see the completion of the Newport Logistics Fund I investments, resulting in a last-mile, net-zero carbon logistics development in the highly sought-after Heathrow area.

Strategically located near Heathrow, Poyle 80 features BREEAM 'Excellent' and EPC 'A' ratings, and premium amenities such as a 50-meter service yard, five dock doors, and EV charging capabilities. This project results from our commitment to providing sustainable and efficient logistics solutions in prime locations across Western Europe. 🏗️🌍

📍 Horton Road, near M25 Junction 14

🤝 Letting agents: DTRE and ACRE Capital Real Estate

Newport Logistics Fund has received the Opportunistic Investor Award at the 14th Annual CEE Investment Awards!

Hosted by EuropaProperty.com at the Intercontinental Hotel in Warsaw, this prestigious event gathered 350 leading professionals from the European and Central European real estate industry. The awards ceremony celebrated achievements across various real estate sectors, recognizing companies with significant contributions and strategic investments in the region.

The warehouse sector continues to demonstrate strong momentum, with exceptional companies like Panattoni and Żabka Polska (Zabka Property Fund) recognized for their contributions. In this competitive field, we are honored to receive the award for Opportunistic Investor of the Year, which highlights our commitment to identifying and maximizing unique opportunities within the market.

🥂 Congratulations to all the winners and industry leaders whose efforts drive the evolution of European real estate!

Welcome to another special edition of the podcast - about big money and big returns from the warehouse market

➡️ How is the fundraising for the third Newport Logistics fund going a month after its launch?

➡️ How many millions of euros did the owners and top managers of Panattoni invest in the fund as seed capital?

➡️ What was it like to start the first fund, which was launched a month after the outbreak of the war in Ukraine?

➡️ Will investors be able to exit it this year?

➡️ Is it possible for interest rates to drop to zero?

Listen to the captain of this ship, Szymon J. Ostrowski from NEWPORT LOGISTICS FUND - it will be a high-calorie 7️⃣ minutes ‼️

Newport Logistics Fund targets €300 million for third pan-European logistics fund.

PRESS RELEASE / 3 October 2024

Newport Logistics Fund targets €300 million for third pan-European logistics fund

Newport Logistics Fund, an investment company, today announces the launch of Newport Logistics Fund III, a pan-European fund that will finance the development, leasing and sale of modern, sustainable logistics properties.

The investment company, which is part of the Panattoni group, is aiming to raise €300 million for its third fund to develop 10-12 facilities across Europe. It has two projects already secured, the first, a speculative development north of London in the UK, and the second, a build-to-suit development in Malaga, Spain. Further investments are in the process of analysis and selection in the rest of Europe.

The launch of Newport Logistics Fund III follows the successful investment of first two Newport funds. Newport Logistics Fund I raised in 2022 and invested in three modern logistics facilities in London, Amsterdam and Lodz with a gross development value of €100 million. The fund is currently completing the construction of all the facilities and is in the process of selling its first asset.

Newport Logistics Fund II was set up in March 2023 and has now invested funds in projects in Austria, the Netherlands, France, Poland and Germany with a gross development value of €200 million.

All Newport projects meet strict sustainability standards. Each facility is designed in accordance with ESG goals and Article 8 of the EU SFDR regulation. All projects will be BREEAM certified (or equivalent).

The Newport series of funds finance the full development cycle (land acquisition, construction, lease and sale) of modern logistics warehouses in Europe and aim to generate a return of 15% a year. They are part of the Panattoni group. Capital is sourced from professional Investors principally high-net-worth individuals and family offices from the EU, Switzerland, the UK, the US and the Middle East.

Daniel Raemy, Member of the Supervisory Board and Investment Committee, said: “Our strategy for the future includes expanding our presence in Europe with more projects as a result of raising more capital”.

Szymon Ostrowski, Managing Director, said: “Our goal is to achieve the returns expected by investors at 15% per year. Our priority is also to develop projects that have a positive impact on the environment. This meets the demand of tenants and the target warehouse owners to whom we sell our facilities”.

“Investors appreciate the diversification of assets in strategic locations and the fact that they are getting the best projects and above-average returns. The confidence of investors, shown in such less favourable economic conditions, is a confirmation that we are able to select the best projects to deliver the promised returns.”

Last-mile, net zero carbon logistics development in sought-after Heathrow area completed.

Panattoni Poyle 80, an investment of Newport Logistics Fund, a Private Equity Real Estate fund that finances the full investment cycle for the development of warehouses in Europe, has completed construction. A 7,400 sq. m last-mile logistics development in the sought-after London Heathrow area was purchased in the first quarter of 2023.

Poyle 80 is a net zero carbon development that was built to a BREEAM sustainability rating of ‘Excellent’ and an EPC rating of ‘A’. The occupier will benefit from a 50m service yard, five dock doors, two level access doors, 12.5m clear internal height, and 37 car parking spaces with 20% EV charging provision.

Located on Horton Road, near junction 14 of the M25, Panattoni Poyle 80 is in one of the Greater London's well-established logistics locations. This strategic location provides immediate access to the UK's largest cargo terminal at Heathrow Airport. The site was acquired in 2023 as part of a £350 million investment in several sites in the southeast. These sites offer value-added development opportunities in core markets with rental growth potential.

"We are very pleased about the completion of Panattoni Poyle 80. This modern, net zero carbon development is a superbly located last-mile warehouse with immediate access to the UK’s largest cargo terminal at Heathrow Airport. We are proud to deliver such a project, which exemplifies our commitment to sustainability and strategic logistics solutions," said Szymon Ostrowski, Managing Director of Newport Logistics Fund.

Letting agents at Panattoni Poyle 80 are DTRE and ACRE Capital Real Estate.

KICKING OFF A WINNING PARTNERSHIP! We proudly announce that Newport Logistics Fund has officially joined the Borussia Dortmund team as an advertising partner! Just like on the pitch, teamwork and strategy are key, and we’re excited to bring our A-game to this collaboration.

PRESS RELEASE / 28 August 2024

A breath of fresh air at the stadium: Newport kicks off collaboration with Borussia Dortmund

Since last weekend, Newport Logistics Fund is an official advertising partner of the Bundesliga club, Borussia Dortmund. With the start of the new Bundesliga season, the young investment company has also become a member of the exclusive BVBBusinessNetzwerk.

The announcement of the new sponsorship proves that Newport, founded in 2022, doesn’t just invest in the development of promising logistics properties. The partnership with Borussia Dortmund will has started right at the starting whistle for the new Bundesliga season. The new head coach Nuri Şahin and assistant coach Lukasz Piszczek will be a breath of fresh air for the Dortmund team.

“As a passionate golfer, I know how important a strong foundation is, both in sports and in business,” says Daniel Raemy, member of the supervisory board and investment committee at Newport Logistics Fund. “With our support for Borussia Dortmund, we would like to carry on the history of success of a club that stands for tradition, passion and excellence.” Carsten Cramer, Managing Director at Borussia Dortmund, is also looking forward to the new collaboration, “BVB and Newport have a shared ambition of looking forward and achieving great things together. This startup investment company brings with it fresh ideas and a future-oriented way of thinking – characteristics that are perfectly in line with our club.”

Newport Logistics Fund is a specialist in the development, rental and sale of high-quality logistics properties throughout Europe. With a strong focus on sustainability and efficiency, Newport relies on top-notch partners and strategic investments. Its investors include private investors, family offices, institutional investors, asset managers and banks. The investment company now has a portfolio with 8 logistics objects in two Luxembourger funds with more than 300 million euros in gross real estate assets (GAV).

The partnership with BVBBusinessNetzwerk provides partners numerous benefits, including a comprehensive events program with regular events in an exclusive environment. Discussions are held on current topics with renowned guests and top-level speakers from the economy, politics, culture and sports sectors. The network offers Newport a platform on which the investors can regularly communicate with other companies in a regional and international context. Members include, among others, GLS, Melitta, Rheinmetall, Aral, Coca-Cola and Rewe. Due to broad rights like perimeter adverts, Newport will also increase its presence and visibility in the DACH (Germany, Austria, Switzerland) region.

About Borussia Dortmund

Borussia Dortmund is one of the oldest and most popular football clubs in Germany. Founded in 1909, BVB has more than 10 million fans here in Germany alone and, beyond that, has a rapidly growing international fan base. The eight-time German champion and five-time DFB (German Football Association) Cup winner became the first German club to win a European Cup in 1966. In 1997, BVB was also the first Bundesliga team to win the UEFA Champions League and, in the same, year, they won the Intercontinental Cup. With a total turnover of more than 500 million euros, Borussia Dortmund is also one of the most financially strongest football clubs in the world.

About Newport

BUILD. LEASE. SELL.

Newport Logistics Fund is startup investment company specialised in the development, leasing and, after completion, sale of high-quality logistics properties throughout Europe. With a strong focus on sustainability and efficiency, Newport relies on top-notch partners and strategic investments in order to create long-term added value for its investors. In 2022 and 2023, Newport created its Funds I and II and successfully invested in eight logistics projects with a total surface area of around 234,000 m² and a project volume of around 300 million euros in Great Britain, Germany, Austria, France, the Netherlands and Poland. Fund III, a SICAV-RAIF fund registered in Luxembourg, will be established in the fourth quarter of 2024. With a target equity capital of 300 million euros and expected gross real estate assets of 600 million euros, Fund III is planning to diversify in at least 10 logistics projects in Europe. The funds are intended for private investors, family offices, institutional investors, asset managers and banks.